COHERENT (COHR)·Q2 2026 Earnings Summary

Coherent Beats on AI Demand, Stock Drops 18% as DeepSeek Fears Spook Investors

February 4, 2026 · by Fintool AI Agent

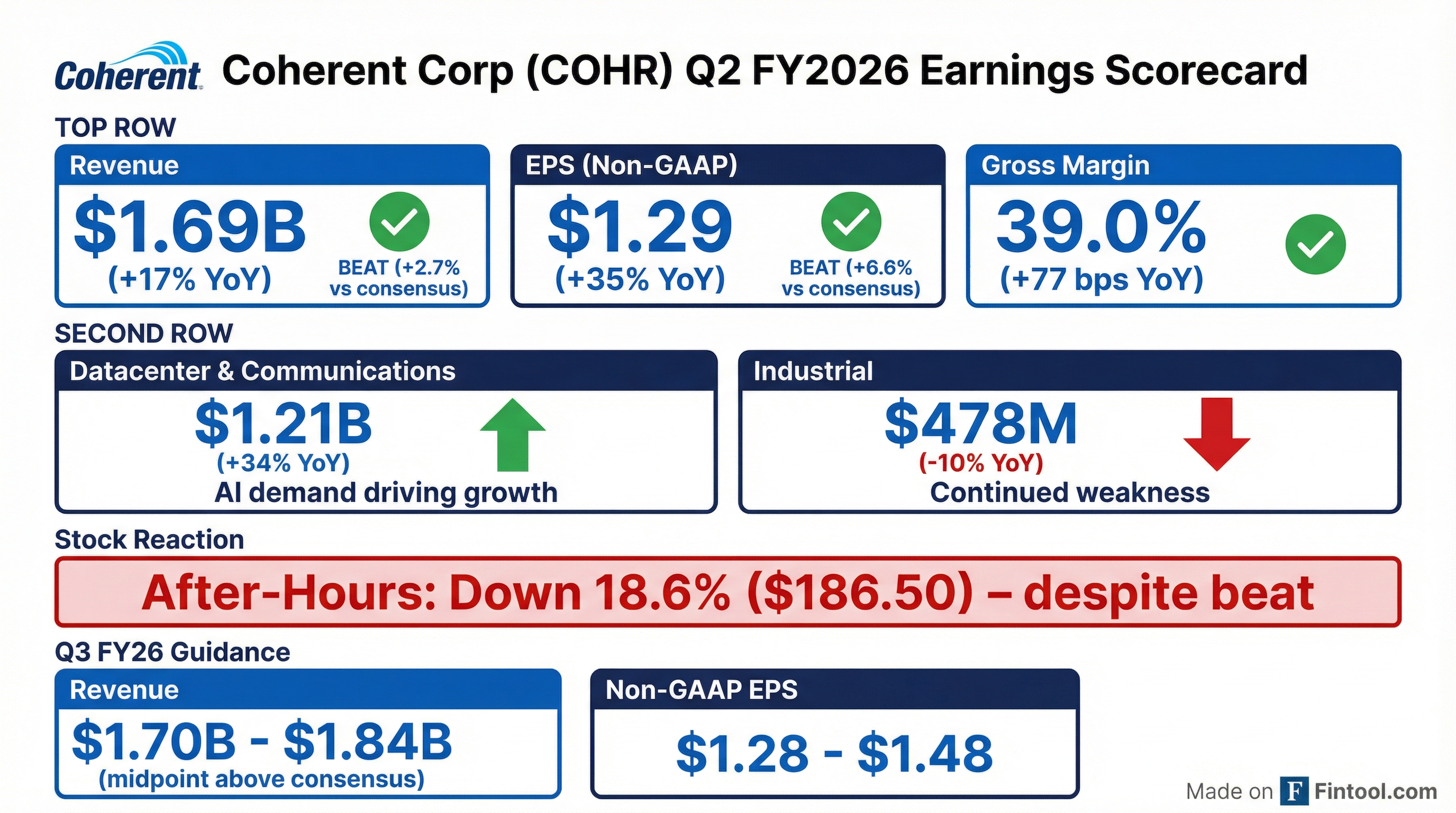

Coherent Corp (NYSE: COHR) delivered a clean beat on both revenue and earnings for its fiscal Q2 2026, with datacenter demand continuing to drive exceptional growth. Revenue of $1.69 billion beat consensus by 2.7%, while Non-GAAP EPS of $1.29 topped estimates by 6.6%. Yet despite the strong results and raised outlook, the stock plunged 18.6% after-hours to $186.50, caught in the crossfire of broader AI infrastructure concerns following DeepSeek's efficiency breakthrough.

Did Coherent Beat Earnings?

Yes — and it wasn't close. Coherent extended its beat streak to five consecutive quarters with solid outperformance across all key metrics:

The outperformance was driven by continued strength in the Datacenter & Communications segment, which now represents 72% of total revenue.

What Changed From Last Quarter?

The story remains the same but is accelerating: AI-driven datacenter demand is overwhelming industrial weakness.

Datacenter & Communications: $1.21B (+34% YoY, +11% QoQ)

The segment continues to benefit from insatiable demand for optical transceivers, coherent optics, and laser components used in AI training clusters. CEO Jim Anderson highlighted "strong demand in our datacenter and communications segment" and expects "continued strong growth in the second-half of fiscal 2026 and throughout fiscal 2027."

Industrial: $478M (-10% YoY, -3% QoQ)

The industrial segment remains challenged, though management noted "improving demand" in their prepared remarks. The company sold its aerospace & defense business in September 2025 and closed the sale of its Munich tools division at the end of January 2026.

Margin Expansion Continues

Both GAAP and Non-GAAP margins improved year-over-year, reflecting operating leverage and cost discipline:

What's Driving the Extraordinary Demand?

The Q&A session revealed several critical details about demand and capacity that paint an even more bullish picture than the headline numbers suggest.

Book-to-Bill Exceeds 4x

Coherent disclosed a book-to-bill ratio exceeding 4x in its datacenter business during Q2, signaling demand is far outpacing current shipments. CEO Jim Anderson noted most of CY2026 is already booked and CY2027 is "filling very, very quickly," with customer forecasts extending into CY2028.

6-Inch Indium Phosphide Ramp Ahead of Schedule

Coherent is executing on the industry's only 6-inch indium phosphide production, which delivers 4x more chips at less than half the cost versus 3-inch wafers. Key milestones:

The 6-inch advantage is becoming a competitive moat, with CEO Anderson noting it was "a key factor" in winning the large CPO purchase order.

CPO Major Design Win

Coherent disclosed an "exceptionally large purchase order" from a market-leading AI datacenter customer for a co-packaged optics (CPO) solution using their new high-power CW laser. The deal was won specifically because the laser is manufactured on 6-inch indium phosphide in Sherman, Texas—highlighting the value of U.S. manufacturing.

- Initial revenue: End of CY2026

- Material contribution: CY2027 and beyond

- Scale-Up opportunity: Management described CPO for Scale-Up as "orders of magnitude larger" than Scale-Out

OCS Platform Gaining Traction

Coherent's optical circuit switch (OCS) business continues to scale:

1.6T Is Margin Accretive

A key investor question was answered: 1.6T transceivers carry higher ASPs and gross margins than 800G. The ramp trajectory:

- Now: EML and silicon photonics-based 1.6T shipping

- H2 CY2026: 200G VCSEL-based 1.6T transceivers begin ramping

- CY2027: Continued strong 1.6T growth off an expanding base

Both 800G and 1.6T are expected to grow in CY2026, though 1.6T is growing faster off a smaller base.

What Did Management Guide?

Coherent provided Q3 FY2026 guidance that appears solid, though the wide range reflects some macro uncertainty:

The Q3 guidance midpoint of $1.77B compares to current consensus of ~$1.71B, suggesting potential for another beat if datacenter demand holds.

Notable: Q3 outlook includes only $5M of revenue from the recently divested Munich tools business, which closed at the end of January 2026.

How Did the Stock React?

Brutal. Despite the beat, COHR dropped sharply:

The selloff appears disconnected from the quarter's fundamentals and more related to:

- DeepSeek overhang — The Chinese AI lab's cost-efficient reasoning model raised questions about whether hyperscalers will sustain aggressive capex

- Valuation reset — COHR had run up 380%+ from its 52-week low of $45.58 to a peak of $241.50, leaving no room for error

- AI infrastructure contagion — Optical component peers saw similar weakness as investors reassess the AI buildout trajectory

For context, COHR is still up over 75% year-to-date and trades at a significant premium to historical multiples.

Key Management Quotes

Jim Anderson, CEO on demand visibility:

"I would say the demand that we're seeing and the visibility extraordinary... Most of our calendar 2026 is booked out, and calendar 2027 is filling very, very quickly. We're also getting really good detailed long-term forecasts from our big customers... forecasts that go out into calendar 2028."

Jim Anderson on book-to-bill:

"In Q2, we experienced another step function increase in our data center bookings, with a book-to-bill ratio that exceeded 4x, as customer demand continues to increase and customers place orders further out in time."

Jim Anderson on supply-demand dynamics:

"It seems like every quarter we think we're gonna catch up, and then the demand keeps increasing. So, I don't foresee the supply-demand getting back in balance this calendar year. I don't think it happens next calendar year... we could be in a very sustained, long period of supply-demand imbalance on indium phosphide."

Sherri Luther, CFO on margin progress:

"If you look at our 39% gross margin for this most recent quarter... we've actually improved our gross margin by about 470 basis points through the elements of the strategy that I've described. We're still, as I would consider, to be in our early stages as we continue to drive toward that greater than 42% target."

Q&A Highlights

Key exchanges from the analyst Q&A session:

On capacity vs. competition (Thomas O'Malley, Barclays): Anderson noted the 4x book-to-bill was "primarily 800G and 1.6T transceiver bookings" with "an acceleration in 1.6T." CPO and OCS also contributed, with bookings expected to remain "incredibly strong" in the current quarter.

On outsourcing strategy (George Notter, Wolfe): Coherent is "very open to outsourcing" for manufacturing that doesn't provide technical or cost advantages. But 6-inch indium phosphide stays in-house: "We're the world's only producer of six-inch indium phosphide." Assembly and test capacity expanding in Malaysia and Vietnam.

On Scale-Up timing (Simon Leopold, Raymond James): Anderson pushed back on the notion that Scale-Up is "years out": "I wouldn't call it years out. I think it's sooner than that, based on the plans that we're seeing from our customers." Coherent can supply at component, laser source, and CPO module levels.

On gross margin drivers (Michael Monty, BofA): CFO Luther outlined three pillars: (1) cost reductions including yield improvements and lower input costs, (2) pricing optimization with "sequential improvements in magnitude," and (3) volume leverage as shipments grow. Mix can create quarterly fluctuations.

On internal vs. external sourcing (Atif Malik, Citi): The majority of indium phosphide lasers are already internally sourced. Given the 6-inch ramp, "the percentage that's internally sourced will grow over time" though external suppliers will remain part of the supply chain for resiliency.

Historical Context: 8 Quarters of Revenue Growth

Coherent has delivered consistent revenue growth as datacenter demand accelerated:

EPS growth has been even more impressive, with Non-GAAP EPS more than tripling from $0.36 in Q3 FY24 to $1.29 in Q2 FY26.

Balance Sheet Highlights

Notable changes:

- Inventory build of $410M suggests management is preparing for continued strong demand

- Preferred stock conversion — Series B Preferred converted to common stock in the quarter, explaining the equity jump

- Debt reduction — Net debt decreased as the company paid down obligations using A&D sale proceeds

Capital Allocation

In H1 FY26, Coherent deployed capital across several priorities:

- Capex: $257.5M invested in property, plant & equipment (up 30% YoY) to expand capacity

- Debt Paydown: Net $335M reduction in borrowings

- Divestitures: $385.8M in proceeds from the Aerospace & Defense sale

The company is prioritizing capacity expansion to meet datacenter demand while maintaining balance sheet flexibility.

Risks and Concerns

-

AI Capex Sustainability — If hyperscaler spending slows due to efficiency gains (a la DeepSeek), Coherent's growth trajectory could stall

-

Customer Concentration — Datacenter customers represent an increasingly large share of revenue, creating binary risk

-

Industrial Recovery Uncertain — The Industrial segment continues to decline; management's "improving demand" commentary has not yet translated to results

-

Valuation — Even after the selloff, COHR trades at a significant premium to historical multiples

-

Inventory Build — The $410M inventory increase could become problematic if demand slows unexpectedly

Technology Highlights

Beyond the datacenter transceiver story, management highlighted key technology initiatives in the earnings presentation:

- XPU Cooling Solutions — Coherent is developing advanced cooling solutions based on 300 mm SiC (silicon carbide) and proprietary Thermadite™ technology for next-generation AI accelerators

- Fusion Energy Lasers — The company is supplying lasers for direct fusion energy generation and for processing superconducting tape used in magnetic fusion applications

- Quantum-Safe Networking — Coherent demonstrated a photonics-enabled, high-quality security-grade random number generator for quantum-safe networking applications

These initiatives diversify Coherent's long-term growth drivers beyond traditional optical communications.

Forward Catalysts

- Q3 FY2026 Earnings: Expected early May 2026 — watch for datacenter demand sustainability

- 800G/1.6T Transceiver Ramp: Next-gen optical products launching through FY26-27; VCSEL-based 1.6T begins H2 CY2026

- CPO Revenue Inflection: Large purchase order begins generating revenue late CY2026, scaling in CY2027

- OCS Production Ramp: Growing backlog and 10+ customer engagements point to significant growth ahead

- Multi-Rail Platform Launch: New DCI product with design wins expected to generate revenue H2 CY2026

- Apple 3D Sensing Partnership: Multi-year agreement revenue begins H2 CY2026, based on Sherman, Texas 6-inch gallium arsenide

- Semicap Recovery: Significant Q2 order increase expected to drive Industrial growth starting June quarter

- Industrial Recovery: Management signaled improving demand, particularly from Semicap equipment customers

The Bottom Line

Coherent delivered exactly what bulls wanted: accelerating datacenter growth, expanding margins, and solid guidance. The 34% YoY surge in Datacenter & Communications revenue confirms the AI infrastructure buildout is alive and well. Yet the stock got slaughtered, down 18.6% after-hours, as macro fears about AI capex sustainability overwhelmed company-specific fundamentals.

For long-term investors, the selloff may present opportunity — the business is executing well and management sees "continued strong growth throughout fiscal 2027." But the violent price action underscores that even great quarters won't protect you when narrative shifts. The next few weeks will reveal whether this is a buying opportunity or a warning sign.

View COHR company page · Q2 FY2026 Transcript · Prior Earnings (Q1 FY2026)